One area I did not touch on in my previous post on team management was hiring.

Hiring is a critical component of building a solid team. It is the “top of the funnel” – you can only work with people you end up hiring. So, it has inordinate influence on future output.

Hire well, and you have an NFL Dream Team. Hire badly, and at best you get a squabbling dysfunctional family. Not much effective team management you can do there.

Here are some of my key learnings on hiring (TL:DR).

1. Hire only when you absolutely need to.

2. Don’t be too hard on yourself. 1 in 3 hires don’t work out – if you do it right.

3. False Positives are OK. False Negatives are not.

4. What to look for in candidates: drive and self-motivation, innate curiosity, and ethics.

5. A few tips for running an interview process. Most important one – do reference checks.

6. How to let people go. Decisively, but with sensitivity. It’s your fault – not theirs – that you hired them into a role where they can’t succeed.

7. Diversity will not happen on its own. You’ve got to make it happen.

A couple of caveats before we jump in:

One, my experience on this slants towards hiring at startups / high growth companies. Not so much mature BigCos, where you’re often pigeonholing people into smaller roles.

The metaphor of the fox and the hedgehog will explain what I mean. As Archilocus said, “The fox knows many things, but the hedgehog knows one big thing”. I’m talking about hiring foxes, not hedgehogs.

Another lens to look at it is value creating vs. value protecting roles, as Keith Rabois says. I’m talking about hiring for value creating roles.

Two, and this is unfortunate, there are no silver bullets or secret ingredients. If you do everything right, it’ll work out… 70% of the time.

With that, let’s begin.

#1: Hire only when you absolutely need to.

This may be obvious in the times of COVID.

But the economy will improve. So it’s worth putting down for posterity.

Hire only when there’s no other choice. If you’re not able to execute well enough or fast enough on the company’s top 3 priorities (or top 1 priority if you’re early stage) – that’s when you hire.

As Henry Ward says in How to hire:

Hiring means we failed to execute and need help.

Hiring is not a consequence of success. Revenue and customers are. Hiring is a consequence of our failure to create enough managerial leverage to grow on our own.

This principle, of hiring as a last resort, is important for two reasons:

- If you hire someone you don’t absolutely need, you’re adding fat. You lose muscle memory of being scrappy and hustling. A fat startup is a slow startup.

- Overhiring makes you fragile when bad times hit (like we need a reminder right now).

#2: Don’t be hard on yourself.

1 in 3 hires don’t work out – if you do it right.

I am a perfectionist. I try and apply Growth Mindset everywhere. Each time I made a bad hire, I would beat myself up, and promise to hire better the next time.

But then I took a step back. And here’s what I’ve learned from making and seeing lots of hires:

No matter what you do, 1 in 3 will not work out. And the more the ambiguity (e.g., senior roles), the higher the proportion of failures.

That’s the nature of the beast. Feature, not a bug.

As Marc Andreessen says:

If you are super-scrupulous about your hiring process, you’ll still have maybe a 70% success rate of a new person really working out — if you’re lucky.

If you’re hiring executives, you’ll probably only have a 50% success rate.

Anyone who tells you otherwise is hiring poorly and doesn’t realize it.

Corollary: Be brave enough to call it when a hire is not working out.

Don’t explain it away.

We’ve all done this. Giving lame excuses. “At least he’s trying”. “It’s still early days. She deserves another chance”. “It’s because people don’t like him!”

When someone is not working out, accept it. Don’t wait for 10 pieces of evidence, 3 are enough.

Why?

Occam’s Razor says, “extraordinary claims require extraordinary evidence”. But the inverse holds too – ordinary claims require only ordinary evidence.

I learned this a few years ago.

I’d been hiring for a role for several months. When a candidate FINALLY seemed to match my requirements, I hired him double quick.

After the first month, one of my colleagues told me that it wasn’t working. I brushed it off, saying it’s too early to judge.

A few weeks later, a second colleague told me the same.

I started making excuses in my own head. “If only the team was more supportive of this new guy”, “these two complainers are too demanding”, and so on.

Luckily I saw through my own bullshit (eventually). I accepted my failure, and took the decision.

1 in 3 hires don’t work out. You don’t need to wait to be absolutely sure. You don’t need to bemoan the lack of perfect conditions. Be honest, and call it.

#3: False Positives are OK. False Negatives are not.

As discussed in the previous principle, false positives will happen, no matter what you do. Yes, they’re 30%-50% of your hires, but that’s OK. It will not get lower.

False Negatives are far more insidious. You don’t know how much they’ll cost you.

Life doesn’t tell you the cost of the path not taken (except in rare cases – like when Facebook rejected Brian Acton for a job, and he then started Whatsapp).

But that is an anecdotal example, you say. You know false positives are bad (have to let good people go); how can false negatives be worse?

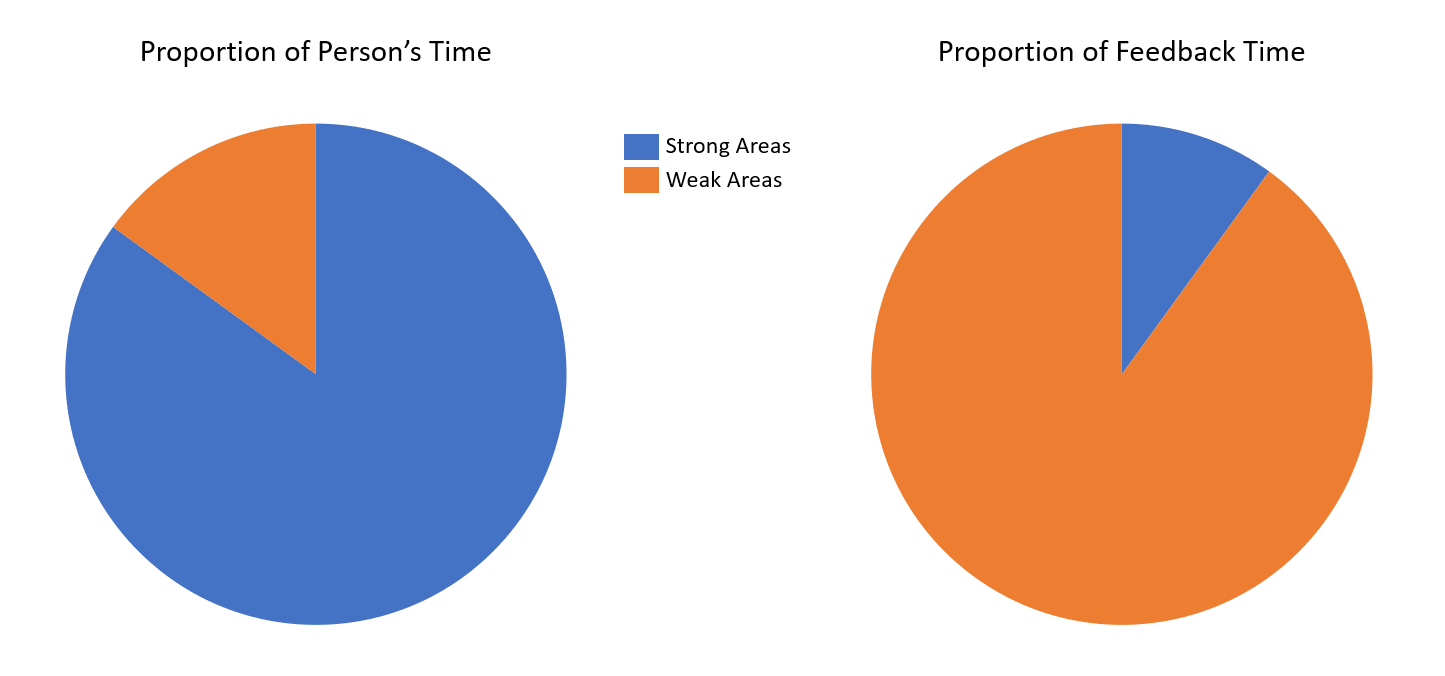

False negatives are worse because like startups, employee effectiveness follows a power law. A strong performer contributes much, much more than a weak one.

You might say that a good employee is only 20% better than a mediocre one. But that stuff compounds! 20% more everyday, and you’re on a completely different continent in a year.

As Henry Ward says:

It is easy to know False Positives but impossible to know False Negatives. This, and a reluctance to fire, is why companies focus on reducing False Positives — it is their only measurement. The phrase “Hire slow, fire fast.” comes from this asymmetry. Companies hire slow because they fear False Positives.

We should not be afraid of False Positives. We can quickly fix a False Positive hiring decision. However, we should be afraid of False Negatives. We can never fix a False Negative mistake. And the cost is unknown and uncapped. Facebook passed on Brian Acton (WhatsApp cofounder) and it cost $8B and a board seat.

It sucks to let people go. I hope we get better at not hiring False Positives. But False Positives is the only way we learn. We learn nothing from False Negatives. And there is a huge risk we miss out on a 20x employee.

The way we get better at hiring is to hire, learn, and improve. Do not be afraid of hiring False Positives. Give people chances. Be afraid of missing the 20x employee.

So don’t spend sleepless nights on whether someone is a great hire or not.

There might not be full consensus among all the interviewers. Some might disagree for subjective reasons.

But if you (as the hiring manager) are still convinced, go ahead. It might work beyond your expectations.

I’ve seen it tons of times. And it’s happened to me personally too – I’ve hired someone despite my colleagues saying it’s a bad idea, and he / she was a lifesaver.

The person you didn’t hire might be the superstar you needed.

#4: What to look for in candidates.

Marc Andreessen lists three things in his article: drive, curiosity, and ethics. And they’ve rung true to me throughout my career.

What is drive?

It’s self-motivation.

People with drive have an inner locus of value. They will not do shoddy work just because they can get away with it.

They have boatloads of determination. They will walk through brick walls to achieve whatever their goal is.

They persevere in the face of ambiguity. Decisions in the workplace are not math problems with clear-cut answers. Can they commit to taking the risks and push through regardless?

You want to hire doers.

But don’t ask candidates if they have “drive”. Ask them to describe something they’ve done that was hard. Could be a previous business, a side-project, even a hobby.

What about curiosity? Why is it important?

Channeling Marc Andreessen again, “Curiosity is a proxy for, do you love what you do?”

You want to hire learners, not experts.

They will encounter new situations, that they have never encountered before. Will the joy of the struggle motivate them?

Ethics are harder to test for.

But if you get the slightest inkling from their background, avoid. Or at least dig deeper.

Now, you’re wondering: all the above make sense. What’s the insight here?

The insight is what’s missing from this list.

Raw intelligence is overrated.

Most roles, even at SpaceX, are not rocket science.

Of course, the candidate should have the right basic skills for the role.

- If it’s a client facing role, they better be able to look you in the eye when speaking to you.

- If it’s an analytical role, they better be able to think and speak logically. Even if they are bad at math.

But beyond that, not much else is needed.

Experience in the specific role is not important.

Every time I’ve seen hires who’ve “done this exact thing before”, it hasn’t worked out.

- Unless they also have drive and curiosity, they tend to be less scrappy and task oriented. “I’ve earned my stripes, now I’ll just guide others.”

- The moment it veers off into the unknown (and it will), what value is the experience?

You’re hiring a person. Not a role.

Hire for what a person can do, not for what they’ve done.

#5: A few tips for running an interview process.

Have a proper funnel to filter candidates.

CV → Phone Interview → In-person interviews → Final Interview.

If you need to hire 3 people and you get 30 CVs, maybe 6 reach the final interview.

This is important, because at the fag end of the process, you’re tired, desperate, and just want to make an offer.

Every candidate will accept or negotiate at different speeds. So you tend to “move down the list”.

Make sure that final list is filtered enough.

Write interview questions down ahead of time.

Reading questions off a page might make your interview come across as “stilted”.

But that’s OK. Better than pretending you’re a great improviser.

Side-note: it’s always better to ask someone to describe something they did (“tell me about a time when…”) than about something they know (“what would you do in this hypothetical scenario…”).

Notice your confusion.

When something doesn’t quite fit, push through and find out.

Every single time that I’ve ignored the slight pause in my head, it hasn’t worked out in the end.

Don’t ignore your unease. Look at it closely – “why is this interview feeling off to me?”.

You might realize it was an unconscious bias. Great, you can now work on overcoming that bias.

But sometimes, you find certain clues gnawing at you below the surface, that something isn’t quite right.

This story is a great example: Noticing You’re Confused.

Do reference checks, and listen between the words.

Always do reference checks.

Keep in mind though: Most references downplay deficiencies when you speak to them.

- “Sometimes wasn’t that motivated” – ouch, best of luck getting quality work out of the person.

- “Was great at solo tasks” – might not be a team player?

- “Made mistakes once in a while”. Not detail oriented at all.

To be clear: I’m not saying just believe what the references say. But pay attention to what they’re saying, and test further in the interviews.

You should try and do reference checks even with people who the candidate hasn’t offered as references.

Yes, I agree it’s a tad controversial.

But here again, important to still give the candidate the benefit of the doubt.

If the reference gives a negative opinion, don’t assume it’s true. But dig deeper with the candidate on that part of their experience.

#6: How to let people go.

Decisively, but with sensitivity.

Given principles #2 and #3, you’re left with a quandary. Any time you hire, there will be false positives. 1 in 3 hires will fail. You will need to let some people go.

I wish there was a way around it. But there isn’t.

Like I often tell myself during self-pep talks (what, you don’t give yourself pep talks?), “Yes, this will be painful. But inconvenience is never a reason to not do something.”

Don’t hem and haw, just do it. Consider, as Andreessen says:

First, realize that while you’re going to hate firing someone, you’re going to feel way better after the fact than you can currently imagine.

Second, realize that the great people on your team will be happy that you’ve done it — they knew the person wasn’t working out, and they want to work with other great people, and so they’ll be happy that you’ve done the right thing and kept the average high.

Third, realize that you’re usually doing the person you’re firing a favor — you’re releasing them from a role where they aren’t going to succeed or get promoted or be valued, and you’re giving them the opportunity to find a better role in a different company where they very well might be an incredible star.

Be decisive, but sensitive.

Remember:

It’s your fault that you hired them into a role where they can’t succeed. Apologize for your failure.

#7: Diversity will not happen on its own. You’ve got to make it happen.

An organization’s culture is defined by who we hire. Not something to be blasé about.

Henry Ward has the best framing of this in How to hire:

You don’t want people who fit into your culture. You want people who grow your culture.

Now, diversity is not just in race and gender. It’s also in ways of thinking.

In my first job, we had a cookie-cutter hiring process for fresh grads: Hire MBA grads, from one business school (“we’re small, and no bandwidth to go to multiple schools”).

We suffered for it, and we didn’t even know.

Later, I saw the impact of hiring wider first-hand. And it became clear.

When perspectives differ even a little bit, they make a huge difference to your output down the road. Questions you didn’t consider, paths you didn’t go down – they all start to matter.

Our natural predilection is to hire people “like” us. Who went to the same schools, have the same hobbies, etc.

We need to fight this. Every time we hire similar, we “protect” our existing culture and entrench it.

Guess what, that magnifies the negative points of our culture too.

Hire different, not similar. Grow your culture, don’t protect it.

As a final word, never take your team for granted. They’re still there after all this. They’re incredible people.

Hope you liked the article! If you’d like more such reads regarding business, management, startups, and anything in between, make sure to sign up for Sunday Reads. Don’t miss the next one!

Further Reading:

- Marc Andreessen on How to hire the best people you’ve ever worked with. It’s an article I re-read every year.

- Henry Ward on How to Hire.

- A couple more articles (and tweetstorms) on how to hire great people, in Sunday Reads #99: Good Questions.

Thanks to Ankesh for asking about this. Check out his newsletter – he’s a wizened veteran at newsletters, and I learn from him every week.